Thai films are dominating the local box office and making a noise in international markets. Screen reports on a buoyant film economy that has received a fresh boost from a new government-backed fund.

Thailand’s domestic film industry is in a buoyant mood after a string of notable commercial successes in 2023 and 2024, as well as achieving an all-time high for local market share at the Thai box office last year.

In 2024, 54 Thai films were released (out of a total of 326 titles), of which eight local films crossed the $3m (thb100m) threshold. “For the first time, Thai films achieved a 54% share of the total domestic box office, exceeding Hollywood films [38%],” says Surachedh Assawaruenganun, M Studio’s CEO and producer, declaring that “it was a historic shift in the industry”.

A pair of Thai films achieved notably strong box-office success in Thailand in 2023: supernatural comedy drama The Undertaker, an Isan-dialect sleeper hit that grossed $23m (thb760m) nationwide; and horror film Death Whisperer with $15.2m (thb510m). In 2024, sequel Death Whisperer 2 raised the bar even higher, becoming the biggest Thai film of all time with $24.7m (thb825m) at the local box office. Family drama How To Make Millions Before Grandma Dies grossed $10m (thb330m) locally, but saw its true impact overseas.

Historic market share

Strength for local films should be viewed in the context of total Thailand box office that has yet to return to pre-pandemic levels: totals for 2023 ($188m/thb6.3bn) and 2024 ($167m/thb5.6bn) compare with a more robust 2019 ($254m/thb8.5bn).

M Studio took the crown as the biggest distributor for two consecutive years, recording the highest box-office revenue of 2023 ($26.6m/thb891m) and 2024 ($39.4m/thb1.32bn). Among the 30 Thai titles it distributed were the Death Whisperer pair, My Boo ($4.5m/thb150m) and Hor Taew Tak: The Return ($3.8m/thb130m). The company’s box-office success contributed significantly to the historic rise in market share of Thai films.

M Studio is the production and distribution arm of the country’s biggest cinema chain Major Cineplex and also works as an international sales agent, expanding the global presence of Thai films. The company, formerly known as M Pictures, was established in post-Covid 2023.

In collaboration with key industry partners such as broadcasters Channel 3, Channel 7, Workpoint and Mono Group, and out-of-home media company Plan B, M Studio is ramping up its ambitious production slate to 20 films this year. Key upcoming titles include franchise entries such as Death Whisperer 3, scheduled for an October release, action drama The Last Shot by 4 Kings director Puttipong Nakthong, and Chanathip Wongpoltree’s horror adventure Ghost Board.

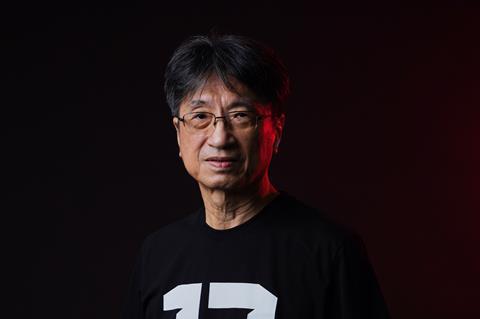

Fresh investors are turning their attention to Thai cinema. A new kid on the block is 13 Studio, the latest initiative from Tanapol Thanarungrot, veteran producer and founder of Phranakorn Film. “Film production has significantly increased recently as TV producers are shifting toward the film industry with declining TV viewership. The competition to dominate the market brings energy and fresh ideas to filmmakers,” says Tanapol. However, he adds: “Budgets remain modest out of necessity. It is becoming more difficult for high-budget film to recoup the investment in this risky economic climate.”

Tanapol has a three-decade career, with credits including The Holy Man film franchise, the popular local comedies about monks. Phranakorn is also a local distributor of foreign films such as Japanese mystery The Floor Plan and runs the Thana Cineplex chain in Bangkok metropolitan area and north Thailand.

“The pandemic has transitioned the world into a new era, one that is no longer aligned with Phranakorn’s existing model of selling locally focused entertainment,” he says. “13 Studio will have a completely revamped vision and direction, focusing on horror films to connect with a new generation of audiences.”

Taweewat Wantha, director of the first two Death Whisperer films, is leading 13 Studio as CEO. His latest horror Attack 13 will open on June 19 in a release window traditionally avoided by Thai films due to intense competition from Hollywood summer blockbusters. “As Hollywood dominance wanes, there is now an opportunity to challenge the convention and take a leap,” notes Tanapol.

Original storytelling

Much of Thai cinema’s allure lies in its unique storytelling, believes Yongyoot Thongkongtoon, co-founder of the country’s leading studio GDH 559, and until recently Netflix Thailand’s content director. “It’s not always about scale or spectacle, but about stories that feel real and resonate across borders,” he says. “The stories are often simple, yet deeply relatable to both local and international audiences. That emotional honesty, cultural specificity and the ability to connect through everyday human experiences remain key.”

A case in point is GDH 559’s breakout hit How To Make Millions Before Grandma Dies, a family drama that touched the heart of global audiences and became the first ever Thai film to make the international feature Oscar shortlist. Its theatrical rights were sold to more than 120 territories through Mokster Films, grossing $55m worldwide, and Miramax has English-language remake rights.

“Since the pandemic, production costs have risen significantly, making international revenue crucial — sometimes even surpassing domestic earnings for certain projects,” says Songpol Wongkondee, GDH 559’s director of sales and distribution, who adds that feedback from international partners “helps shape and improve future productions”.

Production will be sustained and supported over the next couple of years, following the launch of a new film fund by Thailand Creative Culture Agency (THACCA), which is handing out $6.6m (thb220m) to 86 projects, including films, series, documentaries and animation in various stages of development, production or post-production.

It is a significant development for the local film industry, and is the first substantial public film grant since 2010. The new grants have been awarded to a mix of commercial and festival films. The latter include Aditya Assarat’s latest project The Thonglor Kids, which is scheduled to go into production in June, and Ratchapoom Boonbunchachoke’s feature debut A Useful Ghost, which will premiere in Critics’ Week as the first Thai film at Cannes since Apichatpong Weerasethakul’s Cemetery Of Splendour in 2015.

Apichatpong first broke into the international scene in the early 2000s before winning the 2010 Palme d’Or with Uncle Boonmee Who Can Recall His Past Lives. But despite the international and festival acclaim, it remains challenging for Thai festival films to strike much of a chord with local audiences.

“Thai commercial films have improved in storytelling quality and their understanding of the local market, but it hasn’t changed much for Thai festival films,” says indie filmmaker Aditya, whose 2007 debut Wonderful Town won Busan’s New Currents and Rotterdam’s Tiger awards. “The gap between what international film festivals want and what the local Thai audience want remains too wide to bridge.”

Commercial projects that have secured the new THACCA fund backing include Piyakarn Bootprasert’s Onethong, Taweewat Wantha’s Tharae: The Exorcist, Thiti Srinual’s Undertaker 2 and Omukade by Chalot Krailerdmongkol and Pakphum Wongjinda.

One concern is policy continuity, explains Panu Aree, general manager of Neramitnung Film. “If the government changes, there’s no guarantee the fund will continue to operate as it currently does,” he says. “Ongoing monitoring of the policy’s stability is essential.”

Omukade is a creature feature backed by Neramitnung Film, which delivered 4 Kings 2 as the third highest-grossing local film in 2023, with takings of $7.5m (thb250m). Its $2m high-budget time-travel adventure Taklee Genesis — which opened in Thailand last September — was sold to North America, Germany and the UK, traditionally cold markets for Thai films.

While the international success of How To Make Millions Before Grandma Dies proved exceptional, Thai films are generally more exportable than those from its Southeast Asian counterparts. “Sales are mostly concentrated within Southeast Asia, where audiences share similar tastes. Horror is the most popular genre, with strong markets in Vietnam, Cambodia and Laos,” explains Panu. “Thai films face difficulties in markets like Japan, South Korea and China, and are nearly impossible to sell widely in western Europe, beyond niche buyers.”

Following two strong years, Thailand’s box office has got off to a slower start in 2025 — despite only negligible impact from the March 28 earthquake that caused some cinemas to close for a couple of days. GDH 559’s LGBTQ+ supernatural comedy The Red Envelope was the only film in the first four months of this year to surpass $3m (thb100m) at the local box office.

Aditya raises the question of whether Thai cinema can build on its recent achievements. “In the mid-2000s, we had a period of success following Ong Bak and Shutter,” he says of the 2003 Tony Jaa sequel-spawning martial-arts hit and the 2004 supernatural horror.

“But many films that came out afterwards were disappointing, causing the brand of Thai films to fade. Now it seems like the Thai industry is back in the same position. It remains to be seen if we learned from the past or will make the same mistakes.”

Box-office figures in this article were supplied by Major Cineplex

No comments yet